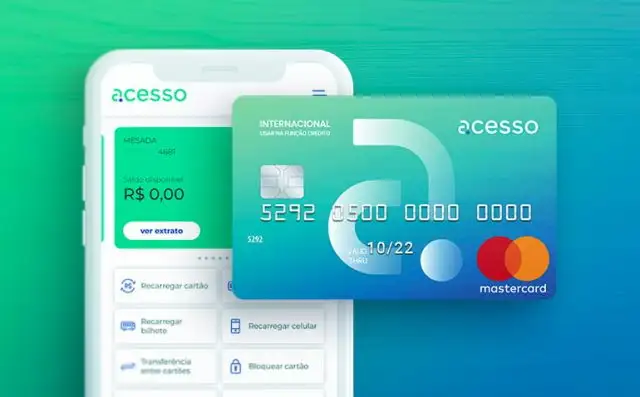

A practical and secure card, without bureaucracy, is what most people are looking for. Even those who are having problems with credit protection agencies can use prepaid cards such as Acessocard. To use it, you need to load it first. Thus, having a balance, the prepaid card works as a common debit card, allowing purchases in physical and virtual stores, payment of bills and all the convenience of the virtual universe.

See below the advantages, disadvantages and other information about the Acessocard prepaid credit card.

Who issues the Acessocard card

The Acessocard is issued by the company Acesso. In partnership with Mastercard, Acesso offers the Acessocard Internacional, allowing the customer to buy in more than 30 million establishments around the world

Difference between prepaid card and credit card

As prepaid cards need to be loaded with amounts to be used, they allow the consumer not to go into debt and lose control of their spending, as with traditional credit cards.

Although it does not have the possibility of paying for purchases in installments, the prepaid card is practical: after contracting it, you can load it with credits via transfer or bank slip.

What is the Access Card limit?

As it is a prepaid card, the amount available will depend on the amount the customer deposits on it.

How does Access Card interest work?

As it is a prepaid card, no interest is charged.

What is the IOF?

As it is a prepaid card, the Tax on Financial Operations (IOF) is collected only on the load/recharge value at 6.38%.

What is the annuity amount?

Accesscard only charges a monthly maintenance fee of BRL 5.95, except when the balance is zero. You do not pay a membership fee if you make an initial top-up of at least R$100. For loads smaller than R$500, a fee of R$2.50 is charged per top-up.

How to apply for the card

To request the Acessocard click on the button below.